The government of the Kingdom of Bahrain has fostered a comprehensive agricultural investment environment, with clear agricultural investment legislations and policies, and has set procedures and requirements for local and foreign investors. The National Initiative For Agricultural Investment has taken the initiative to collate this information and has issued the Agricultural Trade and Investment Guide for the Kingdom of Bahrain 2023 which outlines the following topics:

The National e-Government Portal contains multiple services such as requesting appointments, submitting requests or inquiries and completing government procedures such as applying for building permits, paying customs fees and taxes and many other services. (Add in Arabic version)

To use the portal, the user must create their own account and receive an “electronic key” or “eKey” that allows a single-entry process for various e-Government services. Please note that many government services have been moved online, and this process is necessary to follow up with many of the applications and licenses discussed later in this guide.

Bahraini citizens and residents can create their own eKey through a short and easy process using their CPR number on www.ekey.bh

The Standard eKey offers a good level of security, requiring the user to enter only the personal number and password to access a limited number of eServices.

Registering for the Advanced eKey ensures the highest level of security and allows access to all eServices including highly confidential eServices requiring the verification of the user's smart card and biometrics. To upgrade your eKey account level from the basic to the advanced level, you can visit any of the following offices:

1) Information and eGovernment Authority in Isa Town

2) Bahrain Investors Center in the Bahrain Financial Harbor

3) Social Insurance Organization in the Diplomatic Area

Note: GCC citizens who wish to register for the electronic key must contact the National Contact Center on +973 80008001, as the process differs slightly.

Sijilat is the online Commercial Registration Portal run by the Ministry of Industry and Commerce. Here, users can make all electronic transactions related to their Commercial Registration (CR), for example:

The site is accessible through a user’s e-key, and there are some online-only features, which are discussed in more detail later in this guide.

For more information, visit www.sijilat.bh

You can review the following websites for more information on potential investment opportunities in the agricultural sector in Bahrain and to get a better understanding of the current landscape:

This would depend on the type and nature of the activity, however, the main departments involved in granting approvals and initial licensing would generally be:

- Ministry of Municipalities Affairs and Agriculture – Municipal Affairs Department

- The Supreme Council for Environment – Environmental Licensing Department

- Ministry of Industry and Commerce – Industrial Development Department

For more information, please visit www.sijilat.bh.

Article (2a) of the Commercial Companies Law (Law No 21 of 2001) and its amendments, identify the types of corporate structures as follows:

For more detailed information on the types of corporate structures and to determine which is most suitable for you, click here.

Practicing the commercial activities in the agricultural sector is permitted for certain legal types of companies as follows:

To find out the legal liability limits of each of these companies, you can review the Legal Requirements Relating to Companies.

There are three types of commercial registration certificates:

As an agricultural investor or entrepreneur, you will be required to obtain a Commercial Registration Certificate with a license for your business activities. For more information, visit www.sijilat.bh.

Yes, CR applications can be completed online, unless there is a specific request or summons from the Ministry of Industry & Commerce (MoIC) to visit or appear in person.

Yes, it is possible to conduct some commercial activities through a virtual store without the need of having a physical office space, however this option is only available to Bahraini citizens.

Currently, 42 activities are authorized to be practiced through the virtual registration, several of which may relate to the agricultural sector (including food packaging, packaging cosmetics or herbs, landscape care and maintenance service activities). To obtain a Virtual CR, you must meet the following conditions:

Noting that:

For more information, you can visit www.moic.gov.bh/en or download this document to view the detailed information and permissible activity types. Please keep in mind that this information may be updated from time to time.

Small and Medium Enterprises can register through the SMEs Registration System. It is an electronic system that allows SMEs to apply for “Small and Medium Enterprises Classification Certificate” issued by the Ministry of Industry and Commerce (MoIC) designating the establishment size. Doing so will enable the owner to access certain privileges made available to Small and Medium Enterprises.

For more information, please visit the SMEs section of the MoIC website

There are no registration fees for the Small and Medium Enterprises Registration System, unless any fees are enforced in the future by the concerned authority.

The terms and conditions for obtaining a CR for work in the agricultural sector are the same as any other business activity and are subject to the rules and regulations of the Ministry of Industry and Commerce. Generally, it is required that:

It is possible for non-Bahrainis to establish a CR for the purposes of agricultural investment. For more information see Section 6 of this guide.

Yes, it is allowed to register for a sole proprietor to work and invest in the agricultural sector, under the regulations and conditions authorized by the Ministry of Industry and Commerce and after obtaining the required license and approvals from all concerned parties.

Note: The “Individual Establishment” commercial business type can be owned only by Bahrainis, GCC citizen and American citizen.

NIAD can support potential investors in the following ways:

Yes, but you must have a valid license to conduct a virtual business from your home from the relevant authorities, which may be subject to periodic change. For more information, you can visit website www.sijilat.bh and select “Search Activities” in the Public Service section. Run a search for “Landscape Care and Maintenance Service Activities” (international coding 813) for more information. Landscape Care and Maintenance Service Activities the only permissible activity that can be performed from home in the Agricultural Sector.

Note: According to GCC Law No. (34) of 2012 regarding the Approval of Seeds and Seedlings Law (Regulation), if a plant nursery is established without a legal license, the violator will be fined up to 500 Bahraini Dinars.

Yes, according to Resolution No. 39 of 2010 regarding organizing home-based business, the Khatwa program provides free legal cover for productive families. The main features of the Khatwa program available to participants are as follows:

For more information you can visit the Ministry of Labor and Social Affairs website www.mlsd.gov.bh.

There is no mechanism for granting subsidized agricultural inputs such as greenhouse covers and irrigation pipes to non-farmers who are not in the Ministry of Municipality Affairs & Agriculture’s approved list of farmers. Company owners who do not hold a farmer ID are not allowed to benefit from the subsidized agricultural inputs. However, individuals may benefit from subsidized pesticides only if they are utilized for personal use in gardens and private farms and not for commercial purposes.

There are several financing entities that grant concessional loans at low rates to Bahraini citizens to support small, medium and microfinance projects and productive families, which include:

It is a development organization specializing in microfinance as one of the support methods for low-income individuals, seeking to empower individuals, unleash their potential, and raise their living standards through. Entrepreneurs may apply for financing from the bank even if they have a foreign partner, as long as they submit the minutes of the Board of Directors meeting indicating the board's approval to apply for financing from the bank, and on the condition that financing will be granted under the name of the Bahraini partner, not the name of the project. Owners of commercial registration, Sijili or participants in the (Khatwa) program can apply for loans.

To view the support of small and micro project programs, you can visit the website www.fmh.bh.

Ebdaa Microfinance Company provides assistance to low-income individuals with an emphasis on women and youth-led projects, in an effort to increase the income of low-income Bahraini citizens and improve their standard of living by transforming their talents and skills into successful projects through the provision of microcredit loans. In the case of a foreign partner, project owners may also request for financing from the bank, provided there is a Bahraini co-guarantor.

For additional information, please visit the website http://www.ebdaabahrain.com/.

There are several agricultural financing opportunities. Individual agricultural financing (granted to a person without a CR) is only available to Bahraini citizens and is subject to BDB’s project evaluation processes. If the applicant for agricultural finance is a company owned by a Bahraini and a foreigner, the bank will consider the application according to their internal financing terms and conditions, which will include a credit check and profitability assessment by BDB. Please note that the terms and conditions for all agricultural loans, whether individual or commercial entity, are subject to change at any time.

For more information, you can visit the website: www.bdb-bh.com.

Bahrain Development Bank Agricultural Financing Program: Bahrain Development Bank has an agricultural financing program at a 0% profit rate of aiming to support agriculture production in Bahrain, available for amounts up to BHD 15,000. Among other requirements, this fund is only available to Bahraini citizens, in owned or leased possession of agricultural land, and is for the sole purpose of carrying out agricultural activity.

For more information about this financing program, visit the Agricultural Loans section on the BDB website.

The Labor Fund (Tamkeen) provides financial support for the development of agricultural projects through establishment and individual specific programs.

Tamkeen has two types of support for the Agriculture Sector:

For more information about these programs and for eligibility criteria, you can visit the website www.tamkeen.bh.

For information on funding available to Foreign Investors, please see Section F10 of this document.

Municipal approval is required to initiate agricultural projects and establish a commercial registration on a farm or any other address. In the case of agricultural projects, the property must have an agricultural zoning, and be in a ‘green belt’ classed area. Along with the appropriate municipal and other authorities' approvals, a farm or plant nursery must already be located on the land, and the commercial registration for the prospective company must include Ministry of Industry & Commerce activity (ISIC4 Code 011) “Crop Production and Plant Propagation”.

Issuance of expat work permits and identification of the number of permitted employees are subject to the Labor Market Regulatory Authority (LMRA) Law and executive regulations, and the Labor Law for the Private Sector. If the employer feels the number of employees is insufficient, they may request the LMRA to increase their allotted staff number, subject to approval.

There is no set amount for administrative fees, as each government agency has special provisions regarding its collection of fees and expenses either by law or according to the regulation decision. These fees are determined according to the submitted application type, fees may be subject to change or update by legislation.

No. According to Article 2 of the Labor Law in the Private Sector (Law No. 36 of 2012) and Article 2 of the Social Insurance Law (Law No. 21 of 2022), the owner’s children or any family members registered as company employees are not covered by the provisions of the Labor Law, and therefore not able to be registered at the Social Insurance Organization.

Yes, this is permitted by law and falls under the Limited Liability Company form of incorporation. Its provisions and regulations are regulated by the Commercial Companies Law and the Law's executive regulations. For more information, visit www.sijilat.bh.

There is no maximum number of partners. For more information, visit www.sijilat.bh.

There is no minimum share price, and it can be of any capital value. For more information on the Ministry of Industry, Commerce and Tourism regulations regarding the establishment of limited liability companies, visit www.sijilat.bh.

If there is just one owner, a declaration of incorporation from the Ministry of Industry and Commerce is sufficient, but if there are several owners, the Memorandum of Association must be provided.

The type of the agricultural crops that are authorized to be cultivated in the Kingdom of Bahrain is subject to the law that concerns the types of crops that are permitted to be cultivated in the Kingdom of Bahrain. The cultivation of Khat or Marijuana is prohibited, and the law punishes anyone who violates this. Cultivation of alfalfa with high water needs is prohibited according to Resolution No. (2) of 2000 with an amendment regarding the prohibition of alfalfa cultivation.

Other forage crops that consume less water may be grown according to what is recommended by the competent authority from the Agriculture Affairs department within the Ministry of Municipalities Affairs and Agriculture, and what does not violate the stipulations under Law No. (15) of 2007 concerning Narcotics and Psychotropic Substances, especially Article (4) thereof and Resolution No. (39) of 2016 with an amending of Narcotics and Psychotropic Substances schedules attached to Law No. (15) of 2007 concerning Narcotic and Psychotropic Substances and its modifications.

The Department of Quarantine and Plant Protection under the Plant Wealth Directorate issues all mandatory pesticide standards and usage regulations. The application of pesticides must meet the required specifications and be approved by the Department of Quarantine and Plant Protection on the following criteria:

For more information on the Pesticide Law, please click here.

If the purpose of testing plant samples in the protective laboratory is to diagnose disease, then the examination will be conducted free of charge. If a person wishes to conduct analysis of soil samples for any non-diagnostic purpose in the Agriculture and Marine Resources Agency’s Fertilizer and Soil Laboratory, a fee of 10 Bahraini Dinars (BD) will be applicable.

The Plant Wealth Directorate, in accordance with the GCC Unified Agricultural Quarantine Law, undertakes analysis of imported agricultural consignments (including vegetables and fruits) at customs ports to ensure that they are free of plant pests. In cases where symptoms of pest infection are noted, samples will be taken from the infected agricultural consignments at the port location to diagnose the infection and identify the pest. The shipment will not be released to maintain overall safety and non-contamination.

The Public Health Laboratories at the Ministry of Health conduct a variety of microbial and chemical tests to check the quality and safety of consignments of local and imported vegetables and fruits to ensure its safety and security for human consumption, in accordance with local, GCC, and international safety standards.

The National Centre for Farm Laboratories provides soil and water analyses that are necessary for the safety of the agricultural sector and the evaluation of sample quality, including electrical conductivity, pH tests, and estimation of calcium carbonate in soil, total dissolved salts, and pH in water.

This service is offered at a maximum of 10 Bahraini Dinars (BD). In the future, the laboratory intends to increase its list of available analyses.

There are numerous industries in the agricultural sector, including but not limited to:

- The applicant must be 18 years or above.

- The ownership percentage by nationality is as follows:

Bahraini : allowed up to 100% ownership.

GCC : allowed up to 100% ownership.

American : allowed up to 100% ownership.

Singaporean, Swiss, Icelandic, Norwegian and Liechtenstein nationals: allowed up to 100% ownership.

More information available on www.sijilat.bh.

To check the activities:

Development projects in the Kingdom of Bahrain are subject to environmental impact assessment procedures in accordance with the categories outlined in Ministerial Resolution (No. 1) of 1998 concerning the environmental assessment of the project. Two categories of agricultural projects have been designated as requiring an Environmental Impact Assessment prior to obtaining a license. The two categories are:

Category (22): Projects and operations that may lead to a significant impact on the soil, such as pollution resulted from the leakage of some harmful elements or compounds from the waste into the soil or the resulting pollution from the excessive use of fertilizers and pesticides.

Category (23): Projects and operations that may lead to significant soil degradation or erosion (by water) or being dragged (by air) as the main projects of agriculture and the main engineering projects that may lead to a modification of the natural water flow.

Environmental Licensing procedures for agricultural projects involve:

Export Bahrain is the official export platform of the Kingdom of Bahrain. It aims to give better solutions and services to export enterprises to meet their goals, stay up with global market demand, and prepare exporters to compete and succeed in the most challenging markets. For more information, contact:

Export Bahrain

Bahrain Financial Harbor, Harbor Gate, Fifth Floor, Manama - Kingdom of Bahrain

Phone: +973 1738 3999

Email: info@export.bh

Website: www.export.bh

Yes, agricultural goods can be exported on the condition of having a valid commercial registration, an export license, and permission from the importing country that specifies the necessary certifications and licenses. The relevant Bahraini certifications and permits are issued by the Plant Wealth Directorate under the Agency for Agriculture and Marine Resources and the Food Control Department at the Ministry of Health and Customs Affairs Department.

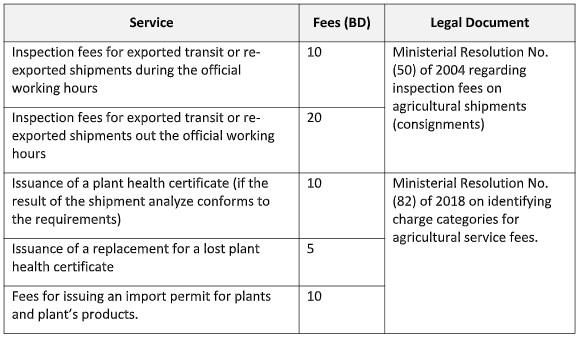

An Agricultural Certificate must be obtained as part of the agricultural quarantine process for agricultural exports or re-exports from the Kingdom of Bahrain. It is issued after an examination of the consignment prior to export and is subject to the following costs:

The Customs Affairs Department in the Ministry of Interior is responsible for regulating imports and exports in the Kingdom of Bahrain.

For more information on import regulations, contact the Customs Affairs Department on the contact information shown in this guide (Chapter 3), or visit the website www.bahraincustoms.gov.bh.

Bahrain follows the Unified Customs Regulation Law for the Gulf Cooperation Council Countries and subsequent executive provisions. For more information on specific matters, contact the Customs Affairs Department or visit the website www.bahraincustoms.gov.bh.

The facility of “Import” and “Export” is already included within the approved activities for Commercial Registrations that contain “Sale or Trade” as their activity. In case the activity does not contain the “Sale or Trade” facility, the investor can submit an online application to add a separate activity to the existing Commercial Registration.

Documents required to complete import clearance procedures:

For more detailed information on documentary requirements for the import of agricultural goods, please review the Unified Customs Regulations of the Gulf Cooperation Council Countries and the executive provisions, available on the Custom Affairs Directorate websitewww.bahraincustoms.gov.bh.

Clearance Procedures:

The authorized person must prepare the import customs declaration at the relevant ports and paying the prescribed customs duties.

Note:

Additional actions:

After submitting the customs declaration using the eCAS system, the customs clearance procedures will be as follows:

The Standard International Trade Classification (SITC) is used to classify imported and exported goods. For additional information on import regulations, please read the Unified Customs Regulations for the Countries of the Gulf Cooperation Council and the executive provisions on the Customs Affairs website www.bahraincustoms.gov.bh.

Yes, the Kingdom of Bahrain benefits from many free trade agreements (FTAs). They are international bilateral agreements that eliminate trade barriers between nations, allowing foreign firms to be treated similarly to domestic firms and benefit from certain privileges.

With the expansion of its free trade agreements, the Kingdom of Bahrain has dramatically expanded its import and export rates, as its imports increased by 48.76% between 2013 and 2018.

For more details about FTAs, you can visit the Bahrain Economic Development Board website: www.bahrainedb.com.

The National Bureau for Revenue (established by Royal Decree No 45 in 2018) is responsible for supervising, controlling, and registering individuals and companies subject to the value added tax.

2018 also witnessed the launch of Law No 48 regarding Value-Added Tax (VAT) and its executive regulations that detail provisions applicable to individuals and businesses engaging in any economic activity. Different rules apply depending on whether the individual or company is resident or non-resident in the Kingdom of Bahrain. For more information, see Section 3.1 and 3.2 of the General Guide of the Added Value

It is recommended to obtain an import permit prior to contracting the shipment purchase. The aim of this is to clarify the conditions of entry for agricultural shipments for both importers and exporters in the country of origin, avoiding any delays or refusals of entry to the consignment upon arrival in the Kingdom of Bahrain in case of non-compliance with customs requirements.

If an import shipment is not preceded by the issuance of a valid permit, the importer will be required to sign an undertaking to complete the necessary procedures before the shipment is released at the port.

Currently, import permits are part of the electronic services available to importers.

Pesticide analysis certificates issued by the Agriculture and Marine Resources Agency are valid for one year, effective from the date of issuance. Within this period, shipments will be exempt from re-testing requirements if they originate from the same company and country of manufacture.

The agricultural quarantine unit analyzes agricultural consignments upon receipt of an analysis request from customs and upon the importer’s submission of all required documents to the agricultural quarantine inspector at the customs port.

Yes, the analyzing fee during the official working hours is 5 Bahraini Dinars and the out-of-hours analysis fee is 15 Bahraini Dinars.

Note: The fees contained in this document are a guide, and actual amounts may be subject to variation by the administrative authority.

Shipments are analyzed at the Agriculture Affairs headquarters in Budaiya or any other location that may be specified by the Ministry of Municipalities Affairs and Agriculture.

When importing or exporting any products, crops, or materials regulated by any of the below government agencies, it is necessary to seek relevant approvals from whichever agency has jurisdiction, namely:

Yes, a foreign investor can invest in the agricultural sector in the Kingdom of Bahrain. The investor can benefit from 100% foreign ownership in most sectors, without the need for a local partner.

See section 2.3 for more details on company formation.

There are several investment opportunities, including activities relating to the production, import, or export of the following:

Innovation outside of these example areas is also welcomed, as long as it does not contradict any laws or provisions of the Kingdom of Bahrain.

Foreign investors are able to benefit from business opportunities in Bahrain that may not be available in the local markets in their countries, helping to diversify their investment portfolio abroad, and opening future international trade potential through Bahrain’s wide logistics and FTA networks.

The Kingdom of Bahrain has the most diversified economy in the Arabian Gulf region, where in 2018, the contribution of the non-oil sectors constituted more than 80% of its total GDP with continued year-on-year increases since 2018.

Bahrain also offers many facilities, easements, and support for trading business, in addition to a strategic geographic position and strong logistics relationships with other countries in the Middle East and the world.

The agricultural sector in the Kingdom of Bahrain is particularly diverse and strong with a lot of potential for development and innovation, making it an attractive investment opportunity for any prospective investor.

The National Initiative for Agricultural Development (NIAD) focuses on the conservation, enhancement, and development of the agricultural sector, to contribute to the Kingdom of Bahrain's social, environmental, and economic development. NIAD can assist in relevant matchmaking with appropriate contacts in the local agricultural market.

There is no minimum investment other than what the Ministry of Industry and Commerce may require, such as determining the capital upon business formation based on the business type and activities.

Bahrain does not have corporation tax, capital gains tax, income tax or other taxes commonly found in other countries. Value-Added Tax (VAT) was introduced on January 1, 2019 by Law No 48 of 2018, and applies to the domestic consumption, import and export of goods and services in the Kingdom of Bahrain.

The base rate of VAT in Bahrain is 10% (as amended by Law No 33 of 2021), although some exemptions on goods, services, and particular business activities that reduce the applicable VAT rate to either 5% or 0%. Additionally, there are some other non-tax fees and levies applied by specialist agencies which a foreign investor may encounter during business activity in Bahrain.

For more information, visit the National Bureau for Revenue website www.nbr.gov.bh.

Yes, a variety of private insurance services are available with licensed local, regional, and global insurance companies operating in the Kingdom of Bahrain. Foreign investors can contact insurance companies directly to acquire more information about the types of insurance offered and packages available depending on their needs.

An investor can seek out potential business partners and enter into any agreement or arrangement with them in any way that suits the parties and their business needs, under the provisions of law. Additionally, The National Initiative for Agricultural Development can help match parties and help the investor find the right contacts in the local agricultural markets.

There are two ways to identify the lands that are allocated are for agricultural use:

For more information, visit the Government Land Investment Platform on www.investmentland.gov.bh.

Through this service, the following information can be found:

For more information, visit the Urban Planning and Development Authority website www.upda.gov.bh

Yes, the government and official agencies do provide assistance towards the development of the agricultural sector. The sort of support is determined by their authority and competencies. The application submission is subject to the conditions of these parties.

Entrepreneurs may apply for financing from the bank even if they have a foreign partner, as long as they submit the minutes of the Board of Directors meeting indicating the board's approval to apply for financing from the bank, and the financing will be under the name of the Bahraini partner, not the name of the project.

In the case of a foreign partner, project owners are entitled to request for financing from the bank, provided that a third Bahraini co-guarantor exists. For additional information, please visit the website www.ebdaabrain.com.

There are several agricultural financing opportunities. Individual agricultural financing (granted to a person without a CR) is only available to Bahraini citizens and is subject to BDB’s project evaluation processes. If the applicant for agricultural finance is a company owned by a Bahraini and a foreigner, the bank will consider the application according to their internal financing terms and conditions, which will include a credit check and profitability assessment by the Bahrain Development Bank.

Note: The terms and conditions for all agricultural loans, whether individual or commercial entity, are subject to change at any time.

For more information, you can visit the website: www.bdb-bh.com.

The Labor Fund (Tamkeen) provides financial support for the development of Bahraini agricultural projects through establishment and individual specific programs.

While Tamkeen supports Bahraini individuals only, Bahrain-based enterprises holding an active CR and who are licensed by authorized entities like Ministry of Industry and Commerce, Information & eGovernment Authority, and National Health Regulatory Authority may also benefit from the support provided by Tamkeen.

For more information about Tamkeen's programs and support, please visit the website www.tamkeen.bh. You can also view additional information related to the agricultural sector through our sector profile report on Agriculture – Tamkeen.

All legislations in the Kingdom of Bahrain are available on the Legislation and Legal Opinion Commission’s official website www.lloc.gov.bh and selected, investment related legislations are available on the Economic Development Board www.bahrainedb.com. Some, but not all, of those legislations are available in English.

Note: see Chapter Two of this guide for a list of the most important legislation related to the agricultural sector in Bahrain.

These disputes are subject to the provisions of the Articles of Association and what is applicable in the Kingdom of Bahrain. In the event of a dispute arising in Bahrain, the jurisdiction is the courts and judicial system of the Kingdom of Bahrain unless otherwise specified by contract or other constitutional documents.

The general origin is the validity and application of the national legislation in force in the Kingdom of Bahrain on the civil and commercial disputes that may arise in the territory of the Kingdom of Bahrain under the centers and legal relations between the disputing parties and are to be considered before the Bahraini judiciary in accordance with the stipulations under the Civil and Commercial Pleading Law No. (12) of 1971 and its amendments, especially Article (5), (22) of the law, unless there are reasons and support for the application of a specific foreign law or the selection of international trade law and its customs depending on the nature of the contract and contracting. It is also required that there is no impediment to the application of foreign law stipulated under Bahraini law in a manner that does not conflict with public order and on condition that the disputed parties must provide the applicable foreign law provisions or the judge is permitted, when not providing them, to consider Bahraini law as the applicable foreign law and he shall be judged accordingly, and this is what is stipulated in Law No. (6) of 2015 regarding conflict of laws in civil and commercial matters of a foreign person, and here it is the applicable national law.

AgroBH can be used as an essential tool to determine trends in the Agriculture Sector by viewing Agricultural Publications and Research, Climatology, Soil, Water and Agriculture Sector Workforce data.

The initiative works to unify efforts between the various stakeholders in the agricultural sector with the aim of encouraging investment in the sector and increase its productivity and sustainability using modern technology in the Agricultural production sector and following the right agricultural practices that ensure resources sustainability and their quality. It also works to overcome obstacles of the agricultural sector development, train, and rehabilitation workers in this sector to be able to keep pace with the global development in this field.

Contact Numbers:

Address: Office - 184, Platinum Tower Building – 190, Road – 2803, Block - 428

Seef District, Kingdom of Bahrain

Fax: +973 17003652

Email info@niadbh.com

Website: www.niadbh.com

(1) Nationality, Passport and Residence Affairs

It is the authority responsible for issuing and renewing passports, issuing and extending visitor visas and issuing residence renewal.

Passport Department: +973 17532198

Visa and Residence Administration: +973 17535325

Website: www.npra.gov.bh

(2) Customs Affairs Department

The Customs Affairs Department is responsible for imposing customs tariffs on exports and imports, controlling entry and exit of goods at land, sea and air borders, inspection of arrivals upon their entry to Bahrain and the application of agricultural quarantine procedures on agricultural consignments coming to the Kingdom of Bahrain at all customs ports.

Phone: +973 17389999 WhatsApp: +973 17389999 Email: customerservice@customs.gov.bh Website: www.bahraincustoms.gov.bh

(3) General Directorate of Civil Defense

The General Directorate of Civil Defense of the Ministry of Interior introduces and enforces safety requirements. They assure the availability of fire prevention and protection requirements and alarm & extinguishing means in the establishments.

Phone: +973 17239300 Fax: +973 17251703 Website: www.gdcd.gov.bh

(4) Coast Guard General Administration

Coast Guard General Administration works to provide a safe maritime environment and to maintain law and order within the territorial waters and the Exclusive Economic Zone (EEZ) of the Kingdom of Bahrain.

Phone: +973 17700000 Fax: +973 1770 4296

The Notary Directorate at the Ministry of Justice and Islamic Affairs conducts documentation transactions and ratification of real estate and non-real estate documents.

Phone: +973 17318998

Website: www.moj.gov.bh/ar

Email: info@moj.gov.bh

The Ministry of Municipalities Affairs and Agriculture aims to achieve balanced urban development through the establishment of an integrated structure for the implementation of the national strategic planning plan, in addition to meeting the 2030 economic vision of the Kingdom of Bahrain.

Phone: +973 17981 000

Website: www.mun.gov.bh/portal

Email: prinfo@mun.gov.bh

(1) Municipalities Affairs

Municipality services are provided through the Municipal Comprehensive Center through which the investor and/or consultant can get all the information that will enable them to start their investment or development project, as well as obtaining a building permit that includes approval of all parties involved in the project in a short period of time and with easy and simplified administrative procedures.

Phone: +973 17981000

(2) Agriculture Affairs and Marine Resources

It is the party responsible for examining plant samples, issuing licenses for importing consignments or agricultural pesticides, examination and application of the plant quarantine procedure on consignments received at the shipping ports, issuing the agricultural certificate for the purposes of exporting or re-exporting plants, plant products or any other materials subject to plant quarantine regulations, drilling of water wells, construction of agricultural drains and drains maintenance works. It also provides training and awareness programs for those interested in agricultural affairs.

Phone: +973 17987000

(3) Livestock Agency

It is the body concerned with preserving the livestock sector, as it controls imports and exports to and from the Kingdom of Bahrain related to animal consignments and their products, in addition to the control and follow-up of the epidemiological situation of livestock inside the animal production farms, as well as It is concerned with controlling and preventing the spread of animal diseases through quarries and veterinary laboratories and the application of regulations and laws related to livestock. It also monitors the veterinary facilities and animal care, regulates the practice of veterinary medical professions, provides advice and technical advice, awareness and education for all livestock breeders.

Phone: +973 17987312

(4) Plant Wealth Department (Department of Quarantine and Plant Protection):

The Plant Wealth Directorate provides pesticide and plant protection services such as the examination of plant specimens and accepts requests for testing and treatment of palm infected with red palm weevil. The department also provides Agricultural Quarantine Services such as examinations and application of agricultural quarantine procedures on agricultural consignments in shipping ports.

Phone: +973 17987213 / +973 17987219 / +973 17987200

Important links:

• Examination and application of agricultural quarantine procedures on agricultural consignments in shipping ports

• Examination of plant specimen

• Obtaining a license to import agricultural and public health pesticides

• Request for examination and application of agricultural quarantine procedures on the imported agricultural consignments at the shipping ports

• Construction of agricultural drains & structures

• Request to drain water into the agricultural drainage network

• Maintenance work for agricultural drainage

• Request for repair and operation of pump stations

• Ground Water Use Permit / Change of Water Use

• Request to drill water wells

The Urban Planning and Development Authority implements the general policy of urban planning and sustainable urban development through providing many services, including land division and merging, planning, classification and preparing structural and detailed draws in various regions of the Kingdom in order to achieve the urban development.

Hotline: +973 80008001

Phone: +973 17682888

Website: www.upda.gov.bh

Food Control Department

The Food Control Department conducts inspection campaigns on restaurants, food preparation and selling shops and warehouses to ensure that shop owners and employees comply with sanitary inspection requirements and controls and examination of food to ensure its suitability for human consumption.

Hotline: +973 39427743

Website: www.moh.gov.bh

(1) Registration Office:

Issuing Commercial Registration (CR) for companies and individual establishments and providing all information and clarifications about the procedures, laws and requirements for obtaining the commercial registration, in addition to evaluation and creation of commercial activities.

Phone: +973 17111200

(2) Companies Control Office:

The Companies Control Office receives annual financial reports for various types of companies registered in the Kingdom of Bahrain, follows up on its financial and legal conditions, reviews requests for auditors’ registration and their registration in the auditors' register and monitors the auditing offices to ensure that the application of accounting standards is properly accredited.

Phone: +973 17111333

Fax: +973 17550836

(3) Inspection and Metrology Administration Office:

Monitoring products to ensure their compliance with their technical requirements and regulations and conducting periodic inspection of shops in the field of measurement and calibration to verify the measurement devices correctness related to weight and measurement.

Phone: + 973 17574 909

Fax: +973 17530730

Email: bsmd@moic.gov.bh

(4) Inspection Management Office:

Preparing and implementing plans, programs and projects necessary to implement the industrial and commercial inspections to ensure the compliance of the various establishments with the laws, ministerial decisions, the related regulations and requirements, monitoring all markets and outlets in the Kingdom of Bahrain, dealing with illegal commercial practices, carrying out field and electronic inspection, dealing with related complaints of commercial and industrial practices received from consumers, relevant government departments or related agencies and taking the necessary action in this regard.

Phone: + 973 17574 877

Email: Inspection@moic.gov.bh

(5) Small and Medium Enterprise Development Office:

Planning and setting mechanisms and policies for the development of the Small and Medium Enterprise sector, supporting leading works, providing advisory and administrative support for sector development, licensing business activity, follow-up on their performance and issuing a certificate for classifying small and medium enterprises.

Phone: + 973 17568034

Fax: + 973 17581504

Email: smedevelopment@moic.com.bh

(6) Industrial Development Administration Office:

Industrial registration and issuance of a license to establish an industrial project, adding an industrial activity, adding an industrial licensing branch, expanding the factory or performing any transactions related to industrial licensing.

Phone: + 973 17568045

Fax: +973 17581538

National Call Center +973 80008001

To apply for a Commercial Registration (CR) or to inquire about a trade name, visit www.sijilat.bh.

(1) Environmental Protection and Control Department:

The Environmental Protection and Control Department receives export notifications for pesticides and responds to them in coordination with the concerned persons in the Department of Plant Resources at the Agency for Agriculture and Marine Resources in a manner that does not contradict with the Pesticides (System) Law and its executive regulations in the GCC and Law No. 38 of 2005 with the approval of the system of (Fertilizers and Soil Improvers for Agriculture Law in the GCC Countries and the international agreements related to these pesticides management that the Kingdom of Bahrain has joined.

Phone: +973 17920213 / +973 17386612

(2) Biodiversity Management:

This department provides the service of issuing licenses and certificates for importing, exporting and re-exporting plants and animals’ species threatened with extinction.

Phone: +973 17386582 / +973 17910863

(3) Environmental Evaluation and Permits Management:

It is the department concerned with assessing the environmental impact and granting environmental licenses for agricultural projects.

Phone: +973 17386653

(4) Environmental Licensing Office:

The primary objective of the Supreme Council for Environment is to safeguard the environment against any potential harm that may arise from industrial ventures. To achieve this goal, the Council grants environmental licenses to facilities, imposing upon the applicant a set of legal obligations and regulations which aid in the attainment of this objective.

Phone: +973 17386993

The Social Insurance Organization provides insurance services to those subject to the Civil Retirement Law, and the Social Insurance Law in the Kingdom of Bahrain, giving investors the opportunity to access information related to the accounting operations, electronic registration, and annual update of the electronically insured’s data.

Call Center and Services : +973 17000707

Website: www.sio.gov.bh.

Tamkeen is concerned with enabling projects to enter the Bahraini market, providing financial support for establishments subject to Tamkeen programs, supporting committed establishments to employ Bahraini employees and support the Bahraini individuals’ skills to increase their competitiveness locally and internationally.

Call Center and Services: +973 17383333

Fax : +973 17382716

Website: www.tamkeen.bh

Email: support@tamkeen.bh

The Economic Development Board provides commercial investment opportunities and gives advice in the investment field.

Call Center: +973 17589999

Website: http://www.bahrainedb.com/en

The Labor Market Regulatory Authority is responsible for issuing work permits for foreign workers in coordination with the competent authorities, such as Nationality Affairs, Passports and Residence, Ministry of Foreign Affairs, Ministry of Health, Ministry of Industry and Trade, Information Authority, eGovernment and the Social Insurance Organization. It is also responsible for regulating the medical analysis for foreign workers and the necessary tests in coordination with the competent authorities, as well as collecting all fees related to work permits and licenses issued in accordance with the provisions of the law.

Call Center: +973 17388888

Customer Service Center: +973 17506055

Expatriate Labor Services Center: +973 17103103

Fax: +973 17552643

Website: www.lmra.gov.bh

Email: lmra@lmra.gov.bh

It is the authority responsible for issuing identity cards, card chips data update services, the issuance of unit / facility number service and address certificate issuance service. You can contact the Government Services Contact Center: +973 80008001 to speak to a representative directly.

The Information and E-government Authority - the main branch will assess information requests and direct the request to the concerned branch within the Information and E-government Authority or to the competent authority.

Phone: +973 17878000 / +973 17377777

Fax: +973 17388338

Website: www.iga.gov.bh

The National Bureau for Revenue (NBR) is responsible for the registration of entities and individuals subject to VAT and Excise, as well as the following:

• Validating the return filings of the entities and the related assessment.

• Collecting the VAT and Excise dues.

• Releasing refunds to the entities.

• Auditing and processing of any appeal.

• Monitoring and enforcement of compliance.

For inquiries about VAT issues:

Local Hotline: +973 80008001

International Hotline: +973 77777333

Website: www.nbr.gov.bh

Email: vat@nbr.gov.bh

Export Bahrain is the Kingdom’s first dedicated platform and the national export development and internationalization support arm of Bahrain that was launched under the purview of the SME Development Board as part of a national effort to support SME business expansion and international growth.

Export Bahrain’s key mission is to promote, nurture and accelerate the growth of local businesses, products and services made in the Kingdom of Bahrain and enable exporters to take on more challenging, high-growth export markets.

Phone: +973 1738 3999

Email: info@export.bh

Website: www.export.bh